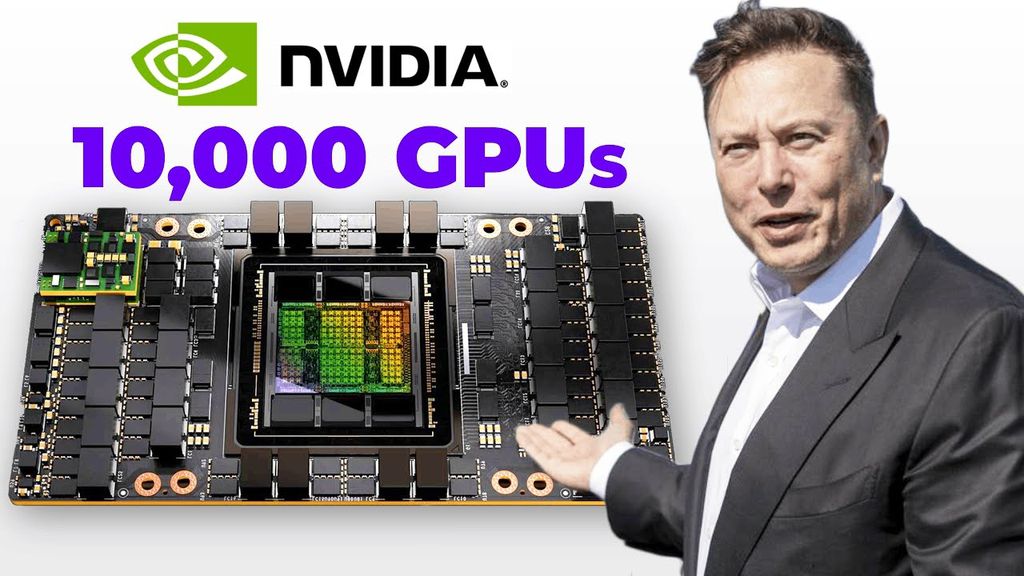

Elon Musk’s artificial intelligence company, xAI, is raising up to $6 billion to bolster its cutting-edge Memphis data center. The funds, aimed at acquiring 100,000 Nvidia H200 chips, represent a significant leap in xAI’s ambition to dominate the AI sector. With an estimated $50 billion valuation, xAI is poised to disrupt the AI landscape further and enhance its computational infrastructure.

A Major Step in AI Infrastructure

According to CNBC, the funding round is expected to close next week, with $5 billion reportedly secured from Middle Eastern sovereign wealth funds and another $1 billion from global investors. This strategic move highlights the increasing demand for robust AI infrastructure, particularly as the race to develop advanced AI models intensifies.

The new chips will join the existing 100,000 Nvidia H100 GPUs in xAI’s supercomputer, Colossus. Nvidia CEO Jensen Huang praised Musk for assembling the current infrastructure in just 19 days, a process that typically takes years. Speaking to Business Insider, Huang called it an “incredible achievement” and a testament to Musk’s focus on accelerating AI innovation.

Why xAI Needs 100,000 More Nvidia Chips

The Memphis data center is central to xAI’s operations, enabling the development of large-scale AI models. With the addition of the new Nvidia H200 chips, xAI aims to double its computing power, meeting the growing demands of training advanced AI systems for various applications, including language models, autonomous systems, and predictive analytics.

“The scale of xAI’s ambitions demonstrates how critical AI infrastructure has become in shaping the future of technology,” noted Amanda Garcia, a senior analyst at Techopedia.

Global Investment in AI

The funding highlights the growing interest of sovereign wealth funds in AI development. Middle Eastern funds, in particular, are increasingly investing in disruptive technologies. As reported by Financial Times, these funds see AI as a key area of strategic importance, aligning with broader economic diversification goals.

This influx of investment not only underscores confidence in xAI’s potential but also reflects the rising importance of AI infrastructure in global economic strategies.

Challenges and Opportunities

While xAI’s rapid expansion is impressive, it also raises challenges. Power demands for the Memphis data center have already required upgrades to local infrastructure. Earlier this year, xAI secured approval to draw 150 MW from the Tennessee Valley Authority, sparking concerns about grid stability.

As noted by TechCrunch, scaling AI operations will also require navigating regulatory hurdles and addressing public concerns about the environmental impact of large data centers.

However, Musk remains optimistic. “With xAI’s vision and our growing computational capabilities, we’re pushing the boundaries of what AI can achieve,” Musk said during a recent company event.

The Future of xAI

As xAI prepares to close its funding round and integrate the new Nvidia chips, the company is well-positioned to become a leader in AI development. Its focus on infrastructure and investment reflects Musk’s broader vision of making AI a transformative force in industries ranging from transportation to healthcare.

The success of this initiative could set a new benchmark for AI capabilities, ensuring xAI remains at the forefront of innovation.